One Small Tweak That Made My Naked Put Strategy Better

I didn’t reinvent my strategy.

I didn’t switch tickers or overhaul my approach.

I made one small adjustment — and it made my naked put trading better in every way.

I’ve always liked selling puts on SPY. For years, I stuck to the textbook approach: sell far out-of-the-money puts, usually around the 5-delta mark. That gave me a 95% implied probability of profit and a decent chance of staying out of the way.

I’d collect about $1.30 in premium and close the trade when I hit 80% of max profit — typically buying it back for $0.30, locking in about a $1.00 gain per contract.

Solid. Reliable. But slow.

To make a $200–$250 profit, I had to sell two contracts, which meant taking on nearly $100,000 in notional risk. And on average, I’d be in the trade for 30 to 40 days.

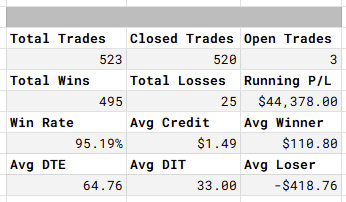

This is what I did going back to 2021:

Recently, though, I made a small tweak:

I moved the strike closer to the money — from 5-delta up to 15-delta.

That drops the implied probability of profit to around 80%, but the tradeoff is worth it: I now collect around $5.00 in premium, and I set a tighter exit — closing at 50% of max profit.

That’s $2.50 profit per contract.

Now I only need one contract to hit my profit target. Notional risk drops to around $50,000, and I’m usually out of the trade in under two weeks.

Same product. Same setup. Still selling naked puts — just with a smarter risk-to-reward structure.

This one small tweak has allowed me to:

-

Risk less capital

-

Exit trades faster

-

Increase profit per trade

-

Trade fewer contracts

Here’s what that’s looked like in practice:

In June alone, I closed 16 trades, all winners, for an average gain of $216 per trade. Average time in trade? 14 days.

Compare that to my older stats:

An average gain of $110 (per contract), and 33 days to get there.

Of course, there are tradeoffs.

A higher-delta put gets tested more often. It moves faster. You need to manage more actively.

But I’m not trying to be safer. I’m trying to be smarter — and more efficient with my capital.

And that’s the key.

There’s no perfect way to sell premium. But if you’re stuck holding multiple low-delta puts for weeks just to grind out small gains, it might be time to see what a slightly higher delta strike can do for your capital efficiency and time in the trade.

-Igor

incomenavigator.com

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.