ZEBRA Options Strategy Explained: Stock-Like Returns Without Buying Stock

zebra

If you've ever wanted to capture the upside of owning 100 shares of stock—without tying up thousands in capital or exposing yourself to unlimited downside—the ZEBRA strategy is worth your attention.

ZEBRA stands for Zero Extrinsic Back Ratio.

The name might sound technical, but the strategy itself is surprisingly straightforward and incredibly effective.

At its core, ZEBRA gives you long stock exposure using call options, while eliminating most time decay and defining your risk from day one.

Let’s break it down step by step.

What Is the ZEBRA Strategy?

The ZEBRA is a three-leg options trade designed to replicate the performance of long stock, but with a fraction of the capital and significantly better risk management.

Here’s how you build it:

-

Buy two deep in-the-money (ITM) call options with the same expiration.

-

Sell one at-the-money (ATM) call in the same expiration cycle.

That’s it. All three options are calls. All have the same expiration date.

This structure gives you close to +1 delta (stock-like behavior), minimal or no extrinsic value (so you avoid theta decay), and a defined maximum loss (the debit you paid to enter the trade).

Why Use the ZEBRA?

Sometimes you want to go long a stock, but you don’t want to risk $50,000 or more buying 100 shares. Other times, you might want to avoid the drag of theta when buying calls outright. And often, you want to know exactly how much you can lose before entering the trade.

ZEBRA solves for all of that. It's capital-efficient. It’s immune to time decay. And it clearly defines your downside risk.

When you structure the trade properly, you end up with a position that behaves almost identically to long stock—without owning a single share.

How It Works in Practice

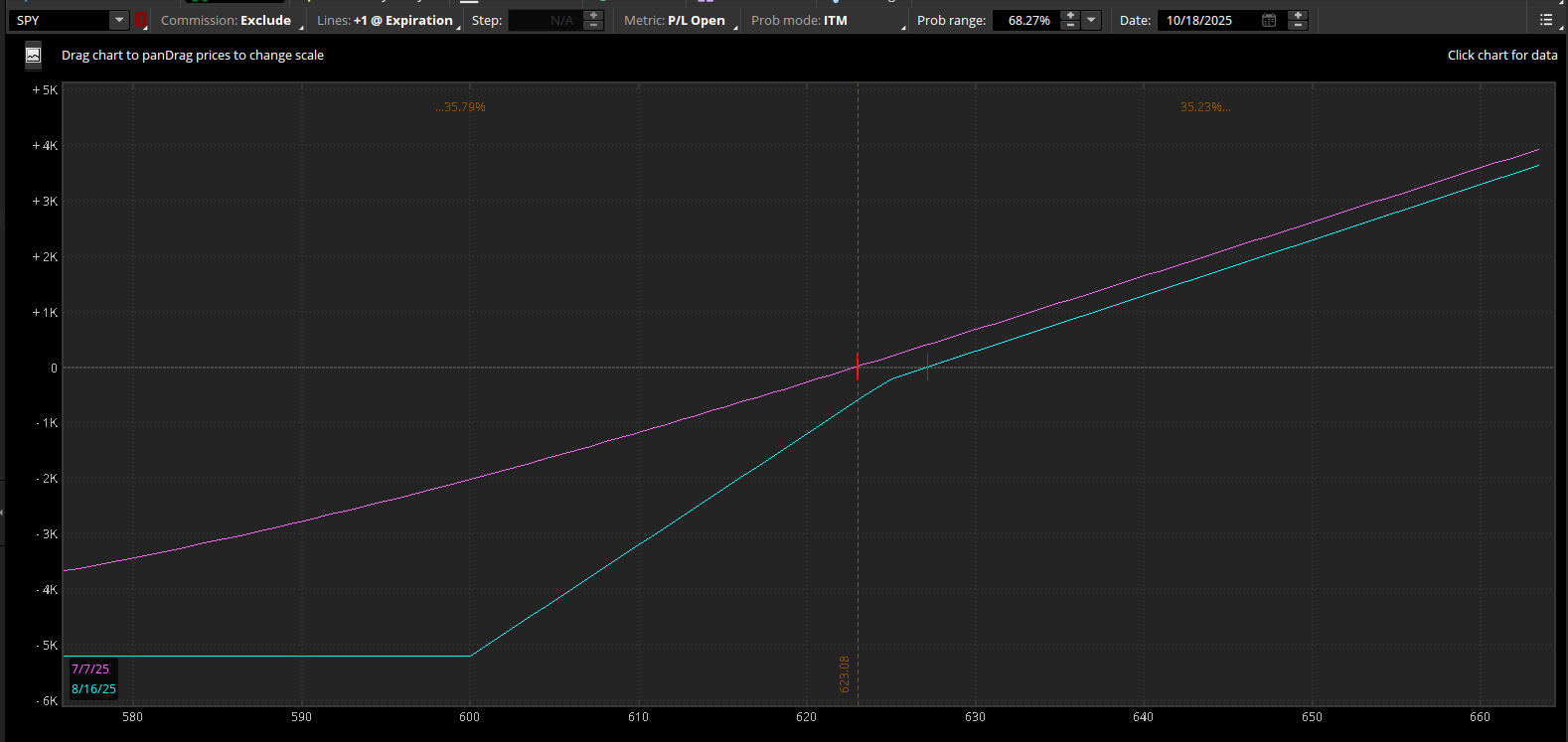

Let’s say $SPY is trading at $623. To construct a ZEBRA, you could:

-

Buy two 600 strike calls (deep ITM)

-

Sell one 625 strike call (ATM)

-

Use an expiration 30 to 60 days out

Assume the 600 calls cost about $35 each, and the 625 call sells for $15.

You’d pay $70 for the two long calls and receive $15 for the short call, for a net debit of 55.00, or $5,500 total.

This is your maximum risk.

No matter what happens, you cannot lose more than $5,500 on the trade.

But if SPY rises above 625, your gains increase dollar for dollar, just like owning 100 shares.

This is what Risk Graph looks like:

Comparing to Buying Stock or Calls

Buying stock gives you unlimited upside and no theta decay, but it also ties up a lot of capital and carries unlimited downside.

Buying calls is cheaper, but those options decay over time, especially if they’re out-of-the-money or have a lot of extrinsic value.

ZEBRA strikes a balance. You get the capital efficiency of options, the upside of stock, no meaningful time decay, and a defined max loss.

It’s not a magic bullet, but it’s a highly effective structure for directional traders who understand how options behave.

When to Use the ZEBRA

This trade shines when you’re bullish on a stock and want long exposure without the full commitment of buying shares. It’s also a great tool when you’re trading in accounts that don’t allow margin or short positions, like IRAs.

If you want to scale into a directional trade slowly, or you want to take advantage of rising volatility without relying on theta-heavy positions, ZEBRA fits well.

Key Takeaways

The ZEBRA is a flexible, defined-risk strategy that gives you the benefits of owning stock without actually buying it. It removes theta decay, limits your downside, and requires less capital to manage.

Once you learn to identify the right setups and structure the trade correctly, it becomes a valuable part of your trading playbook.

If you're looking to trade smarter—not bigger—the ZEBRA strategy is one of the best tools available.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.